Cell Phone Tester Jobs: How Phone Systems and Analytics Are Used in Accounting

Cell phone tester jobs are often discussed in the context of modern phone systems and analytics. This article explains how mobile testing, call data, and phone analytics support accounting workflows, accounts software, and call management solutions in digital businesses.

Modern accounting departments rely heavily on integrated phone systems and data analytics to streamline operations, improve client communication, and enhance financial accuracy. As businesses adopt cloud-based solutions and mobile technologies, the role of telecommunications in financial management has expanded significantly. This integration has transformed how accountants track expenses, communicate with clients, and analyze business communications for strategic insights.

What Does Mobile Device Testing Involve

Mobile device testing encompasses quality assurance processes that ensure smartphones and tablets function correctly before reaching consumers. Professionals in this field examine hardware components, test software applications, verify network connectivity, and identify potential defects. The work requires attention to detail, technical knowledge of operating systems, and understanding of user experience principles. Testing environments range from laboratory settings to real-world usage scenarios, with testers documenting bugs, performance issues, and compliance with industry standards. These positions typically require technical aptitude, problem-solving skills, and familiarity with testing protocols and documentation procedures.

Understanding the Responsibilities in Testing Roles

Quality assurance positions in mobile technology involve systematic evaluation of device functionality across multiple parameters. Testers execute predefined test cases, perform exploratory testing to uncover unexpected issues, and collaborate with development teams to resolve identified problems. Responsibilities include verifying touchscreen responsiveness, camera quality, battery performance, and application compatibility. Documentation plays a critical role, as testers must create detailed reports that engineers can use to replicate and fix issues. The work demands patience, analytical thinking, and effective communication skills to bridge the gap between technical teams and end users. Many positions also require understanding of automated testing tools and scripting languages to enhance efficiency.

How Phone Systems Integrate with Accounting Software

Contemporary accounting practices increasingly depend on Voice over Internet Protocol systems and integrated communication platforms that connect directly with financial software. These systems automatically log call durations, associate conversations with specific client accounts, and generate expense reports for telecommunications costs. Integration allows accountants to track billable hours through phone records, monitor client communication patterns, and ensure compliance with documentation requirements. Cloud-based phone systems provide real-time data synchronization across multiple locations, enabling distributed accounting teams to maintain consistent records. Features like call recording and transcription support audit trails and dispute resolution, while automated routing ensures clients reach appropriate financial advisors efficiently. This technological convergence reduces manual data entry, minimizes errors, and provides comprehensive communication histories that support financial decision-making.

The Role of Analytics in Financial Communication

Phone analytics tools extract valuable insights from communication data that inform accounting strategies and business operations. These platforms analyze call volumes, peak communication times, average handling durations, and customer inquiry patterns. Accounting departments use this information to optimize staffing levels, identify training needs, and improve client service quality. Advanced analytics can detect unusual calling patterns that may indicate fraud or compliance issues, providing an additional layer of financial security. Sentiment analysis of recorded conversations helps assess client satisfaction and identify potential account risks before they escalate. Data visualization dashboards present communication metrics alongside financial performance indicators, enabling managers to understand correlations between client interactions and revenue patterns. This analytical approach transforms phone systems from simple communication tools into strategic assets that drive business intelligence.

Practical Applications in Modern Accounting Practices

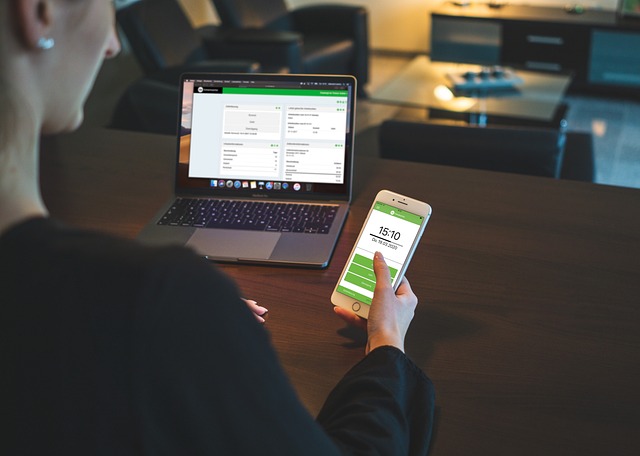

Accounting firms implement phone system analytics to enhance operational efficiency and client relationship management. Call data helps allocate overhead costs accurately across different service lines and client accounts. Tracking which clients generate the most communication volume allows firms to adjust billing structures and resource allocation accordingly. Phone systems integrated with customer relationship management software automatically update client records with interaction histories, ensuring accountants have complete context before financial discussions. Mobile applications connected to these systems enable accountants to access client information and communication logs remotely, supporting flexible work arrangements. Automated call distribution based on expertise areas ensures clients connect with accountants who specialize in their specific financial needs, improving service quality and reducing resolution times.

Skills and Knowledge for Technology-Integrated Accounting

Professionals working at the intersection of telecommunications and accounting need diverse competencies spanning both domains. Technical literacy includes understanding cloud-based phone systems, data analytics platforms, and software integration principles. Financial expertise remains fundamental, encompassing accounting standards, regulatory compliance, and financial reporting requirements. Analytical skills enable interpretation of communication data and identification of meaningful patterns that inform business decisions. Adaptability is essential as technology evolves rapidly, requiring continuous learning and willingness to adopt new tools. Communication abilities help translate technical capabilities into business value for stakeholders who may lack technical backgrounds. Project management skills support successful implementation of integrated systems, coordinating between IT departments, accounting teams, and external vendors to ensure smooth deployment and adoption.

Conclusion

The convergence of phone systems, analytics, and accounting practices demonstrates how technology reshapes traditional business functions. While mobile device testing represents a distinct career path focused on quality assurance, the integration of communication technology with financial operations creates new possibilities for efficiency and insight. Accounting professionals who understand these technological tools gain competitive advantages in client service, operational management, and strategic planning. As businesses continue adopting integrated solutions, the relationship between telecommunications and financial management will likely deepen, creating opportunities for innovation and improved practices across industries.